I’ve never been a huge fan of Accounting, it is kind of a necessary evil. You need good books to give insight into the health of your business, but it requires painful discipline and details to make sure the info is accurate, and it doesn’t immediately feel like it contributes to growth. When I started my seven-figure business, I initially started with just keeping a record of expenses in a Google Sheet, recording every transaction by month; and then added a roll-up tab that pulled the totals of each month for each expense, so I get the overall snapshot. This was probably the first year in business.

At some point, after we scaled, we needed to hand off this mundane work to a service provider – not just for the regular bookkeeping, but also the closing of the books after the year’s end for tax purposes. We used a startup called Bench Accounting, which recently had been experiencing financial troubles before an 11th hour acquisition. One big lesson learned is that while startups are disruptive and intriguing (and cheaper) to work with, there is of course an inherent risk in working with them. I found out the hard way when I couldn’t access my financial data for a period of time.

This leads me to my decision-making process when considering a bookkeeping platform / service for this new business. There are different needs as it isn’t an Ecom business, it is in the service side. I am in the process of working with my first client as a consultant, and need an accounting system to issue invoices and collect. In a brief search, I have narrowed it down to two:

Fresh Books vs. Quickbooks online

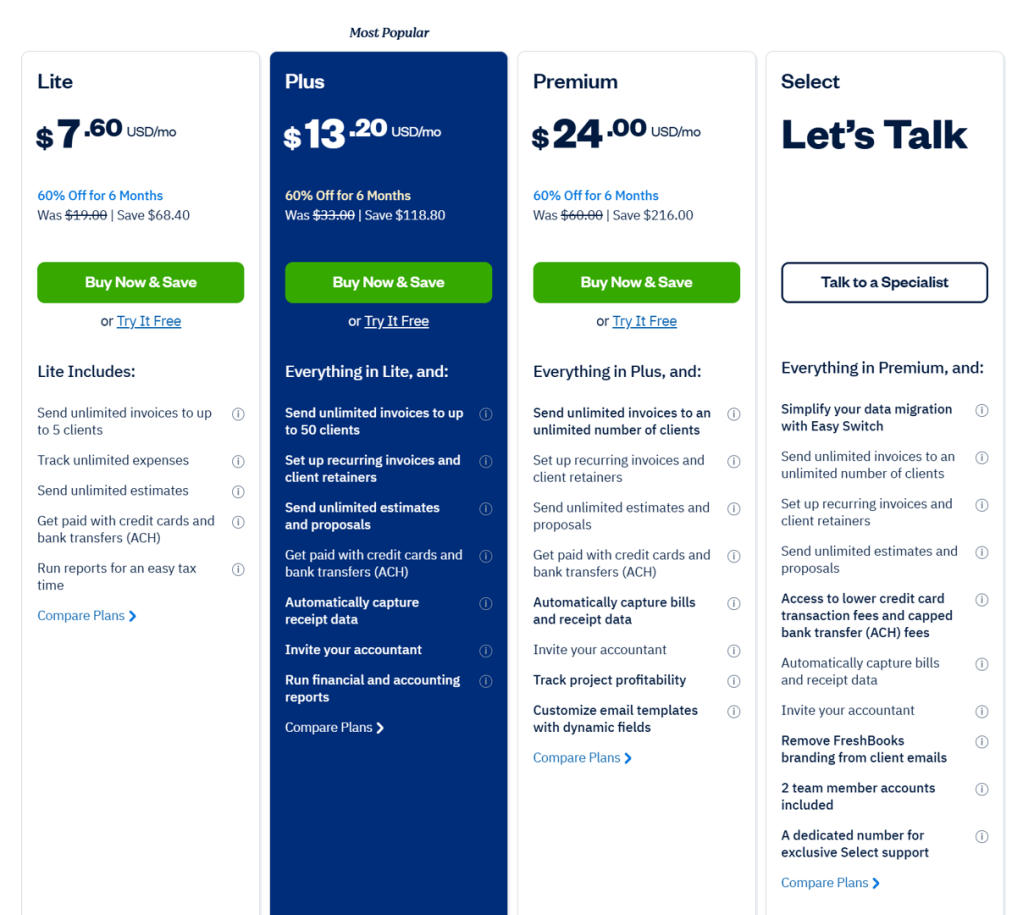

Each provide their delineated list of features and benefits in their pricing. Here’s Fresh Books:

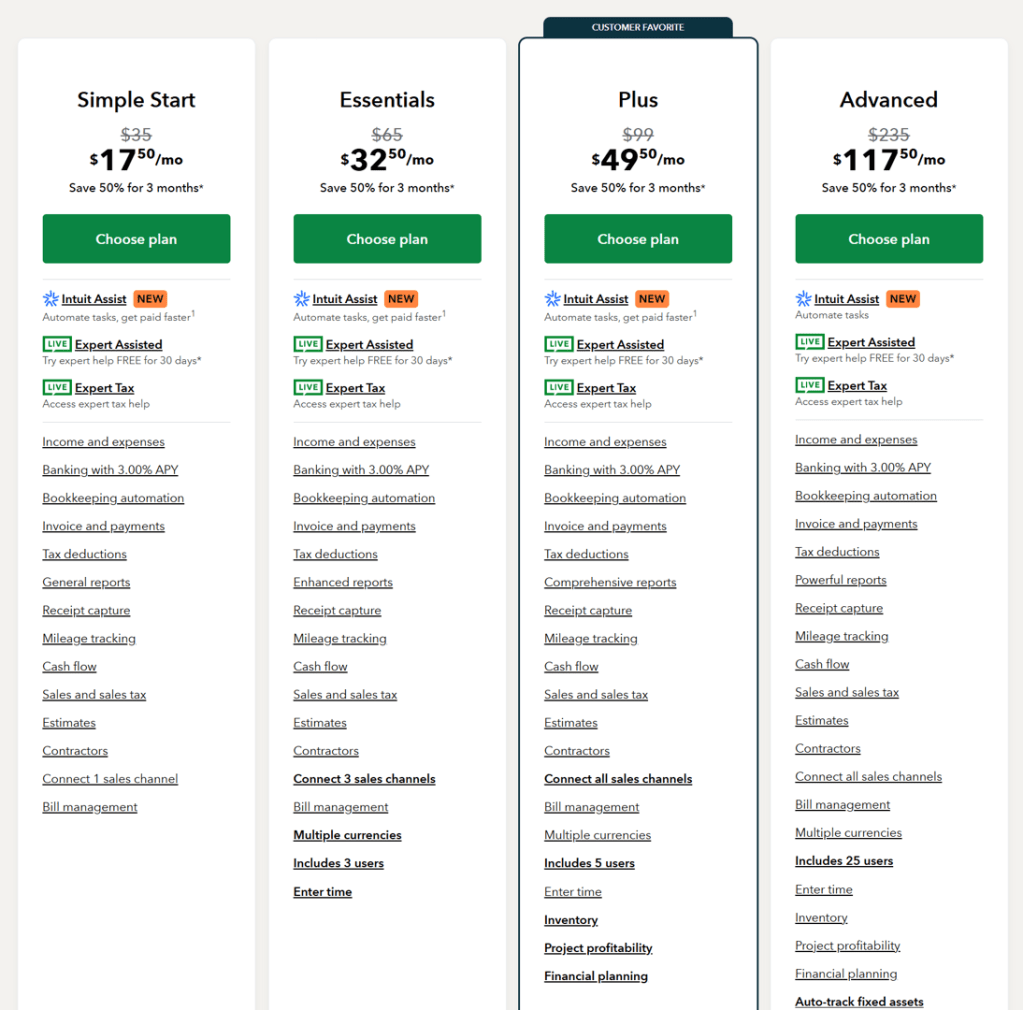

And here’s Quickbooks:

At first glance, my eye goes immediately to the left to see what the cheapest plan is and if it meets my needs. I also need to consider the state of each company. Fresh Books is kind of a start up, which means some of the aforementioned risk; whereas Quickbooks has been around for decades so we know there’s no concern there. Additionally, I need to think about longer term as we scale; can the service scale with my business? Clearly you get what you pay for. QB’s plans are more expensive, but do seem more robust in their offering. FB’s plans are lower but more limited in capabilities.

For my immediate needs, I only need the ability to issue invoices and track expenses (automatically would be nice). So it appears that Fresh Books (lowest price) is the right choice at this time.

Another consideration is the concept of one-way doors vs. two-way doors, that I learned from a talk by this guy:

When making decisions, if it is a two-way door, that means that if that decision turns out to be wrong, while costly, you can feasibly go back through that door and pivot. On the other hand, if it is a one-way door, there needs to be much greater consideration because that decision would be a point of no return.

In this case, I believe it is a two-way door situation, where the cost of pivoting would be minimal (the longer I’d stay with Fresh Books, the more data is housed there and the more costlier it is to change) as I am sure I can export the expense history and import it easily into Quickbooks or some other tool. So it’s best to go with the least cost option (if it meets your needs), see how it performs as the business scales and gets more complicated (perhaps after a year), and then make a determination to stay or go. Also, since it appears to be month-to-month and no long term contract / commitment, there is no negative consequences to terminating the service.

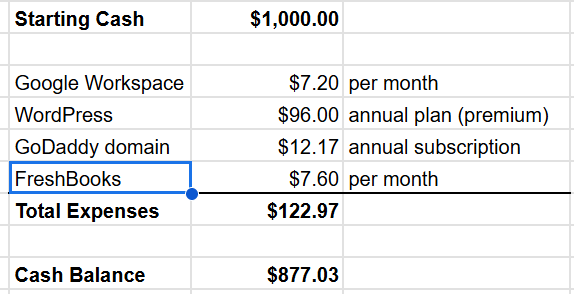

So, if I do a breakdown of my costs so far this month, they are as follows:

Accounting, let’s go!

Leave a comment